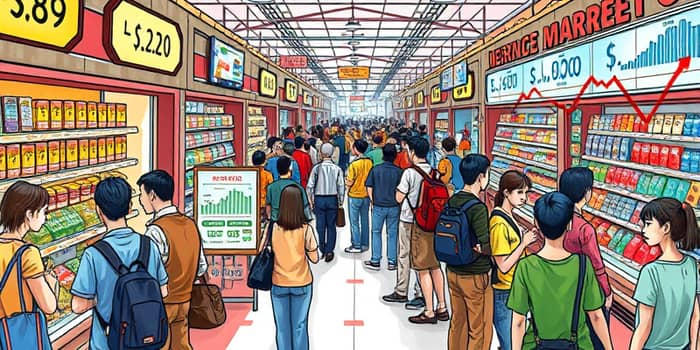

In today’s rapidly evolving marketplace, understanding how consumers react to price shifts is more critical than ever. From multinational corporations setting global strategies to policymakers shaping tax regimes, measuring demand responsiveness provides the roadmap to informed decisions.

This guide dives deep into the world of price elasticity of demand, offering practical insights, real-world examples, and strategic applications designed to empower businesses, economists, and curious readers alike.

Understanding Price Elasticity of Demand

Price elasticity of demand quantifies how the quantity demanded of a good changes in response to price fluctuations. Mathematically, it is expressed as the percentage change in quantity demanded divided by the percentage change in price.

When consumers are highly sensitive to price movements, demand is considered elastic. Conversely, if price changes barely move the needle on quantity, demand is inelastic. A value equal to one signals unit elasticity, where price and quantity drop or rise in perfect sync.

Types of Elasticity and Consumer Behavior

Elastic demand occurs in markets with abundant alternatives or discretionary spending. For instance, luxury handbags often see buyers postpone purchases when price tags climb.

Inelastic demand characterizes essential goods that occupy significant portions of daily life. Even substantial price hikes for items like salt or tap water rarely lead to large shifts in consumption.

Unit elasticity is rarer but critical in theoretical models. Here, the percentage change in price exactly matches the percentage change in quantity consumed, offering a neutral response.

Real-World Examples

Across sectors, goods and services illustrate the spectrum of elasticity. Recognizing these patterns helps companies craft pricing strategies and governments anticipate tax impacts.

- Designer Handbags and High-End Fashion

- Airline Tickets with Dynamic Pricing

- Fast Food Chains Offering Multiple Alternatives

- Book and Magazine Subscriptions

- Branded Chocolate Bars

- Household Utilities such as Tap Water

- Gasoline for Daily Commutes

- Medical Necessities and Prescription Drugs

- Basic Food Staples like Rice and Salt

- Cigarettes and Addictive Goods

Factors Influencing Price Sensitivity

Several variables shape how consumers respond to price changes. The presence of substitutes, the necessity of the product, and the time horizon all play pivotal roles.

For example, a sudden spike in electricity prices may not deter households in the short term, but over months, consumers invest in energy-efficient appliances, illustrating rising elasticity over time.

Calculating Elasticity

The fundamental formula is simple: Percentage Change in Quantity divided by Percentage Change in Price. A result above one means high sensitivity; below one indicates low sensitivity.

Consider a 10% price increase that causes quantity demanded to fall by 15%. Dividing -15% by +10% gives an elasticity of -1.5, classifying the good as elastic.

Applying Elasticity for Strategic Advantage

Businesses leverage elasticity to optimize pricing. Companies selling elastic products often introduce promotional discounts or bundle deals to attract cost-conscious buyers, while firms with inelastic offerings can maintain higher margins.

In public finance, elasticity informs tax policy. Governments impose heavier levies on inelastic goods—such as tobacco—to raise revenue without dramatically shrinking consumption.

Case Studies: Insights from Industry Leaders

Major luxury brands periodically adjust price points to test thresholds of consumer willingness. When prices dip slightly, demand surges, proving strategic revenue optimization in action.

Airlines maintain complex algorithms that monitor booking patterns, adjusting fares by the minute to match shifting demand curves.

Fast food chains analyze sales data from discount campaigns, refining menus to highlight high-demand, elastic items that drive foot traffic while balancing profit per sale.

Conclusion: Empowering Decisions with Elasticity

Mastering price elasticity equips stakeholders with the ability to forecast consumer reactions, tailor pricing strategies, and craft policies that balance revenue with social impact.

By integrating these insights, businesses can foster sustainable growth, and governments can design equitable fiscal measures—ensuring markets remain vibrant, responsive, and fair for all participants.

References

- https://www.symson.com/blog/price-elasticity-of-demand-examples

- https://competera.ai/resources/articles/price-elasticity

- https://www.khanacademy.org/economics-finance-domain/microeconomics/elasticity-tutorial/price-elasticity-tutorial/a/price-elasticity-of-demand-and-price-elasticity-of-supply-cnx

- https://www.economicshelp.org/blog/7019/economics/examples-of-elasticity/

- https://en.wikipedia.org/wiki/Price_elasticity_of_demand

- https://www.sparknotes.com/economics/micro/elasticity/section2/

- https://corporatefinanceinstitute.com/resources/economics/price-elasticity/

- https://www.beyondcostplus.com/pricing-resources/pricing-examples-case-studies/price-elasticity-examples

- https://blog.blackcurve.com/price-elasticity-a-simple-explanation

- https://www.youtube.com/watch?v=5Ce5bFAL2OE

- https://sawtoothsoftware.com/resources/blog/posts/pricing-elasticity-of-demand

- https://www.paddle.com/blog/price-elasticity

- https://www.stlouisfed.org/open-vault/2024/june/price-elasticity-demand-explained

- https://hbr.org/2015/08/a-refresher-on-price-elasticity